best mechanical breakdown insurance for everyday drivers

Why it matters mid-journey

I watched a barista's hatchback cough on the ramp, hazard lights tapping like metronomes. One call to her plan, a tow arrived, and a loaner kept her shift alive. That snap-to-action felt safer than gambling on savings and crossed fingers.

Quick moves before you buy

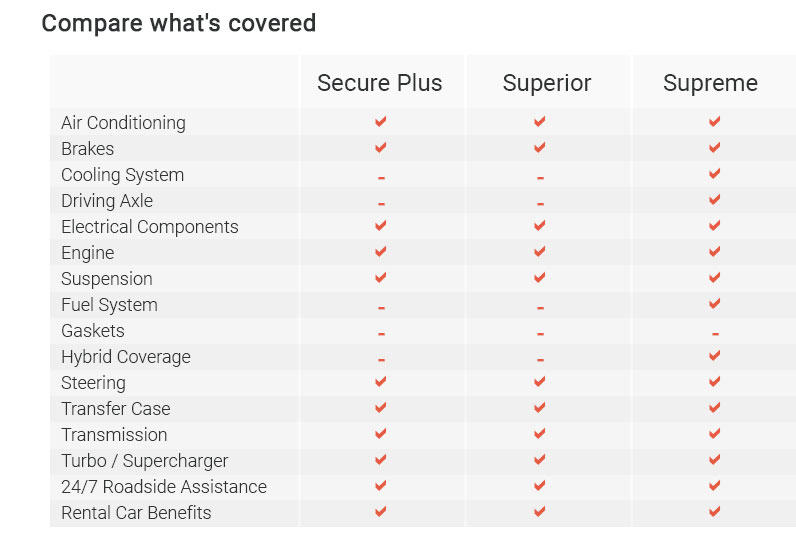

- Match coverage to mileage - newer cars need electronics protection; high-mile cars need drivetrain depth.

- Check claim speed and after-hours help; breakdowns ignore business hours.

- Ask about shop choice; freedom matters when you're far from home.

What "best" actually looks like

- Clear exclusions you can recite without squinting.

- Diagnostics covered, not just the repair.

- Nationwide network and easy reimbursement.

- Reasonable deductible that won't stall repairs.

The bold take says "get the biggest plan." Maybe. On a second look, the right plan fits your commute, climate, and maintenance history, not a brochure. Safety grows from predictable help, verified limits, and a claims team that answers on the first ring.

Picture a wet night, shoulder slick, trucks streaming. You tap the app, share location, and wait under dome light. Minutes later, beacons bloom. That's the quiet promise you're buying - action now, repair tomorrow, you home safe.